Cost to Company

Cracking the Code: Understanding Cost to Company (CTC)

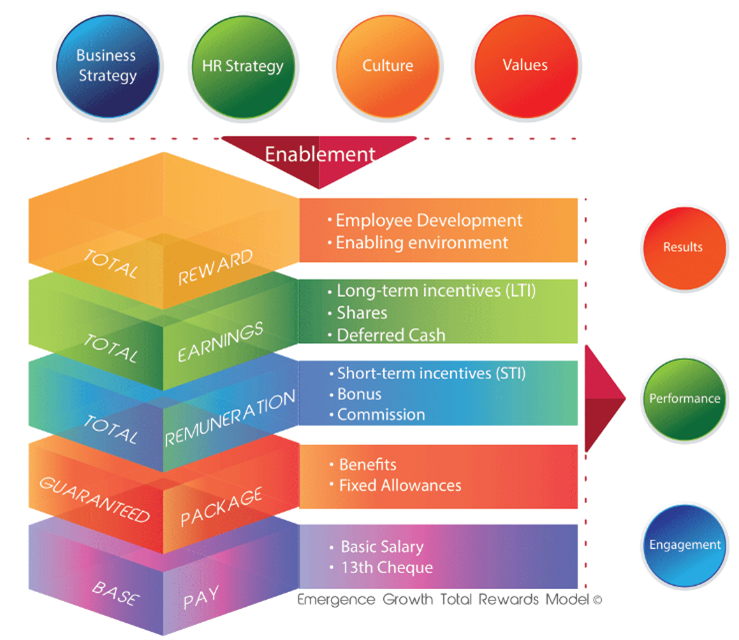

Cost-to-Company, also known as CTC or Guaranteed Package / Pay, is the most used pay approach across Southern Africa. It is the calculated as the sum of all fixed income (including Basic Salary), fixed allowances & benefits as well as the employer contributions to Employee Benefits. CTC packages are typically driven by internal equity, external market competitiveness and flexibility for the individual. In the realm of employment and job offers, the term “Cost to Company” (CTC) holds significant weight. It represents the total expenses borne by an employer for an employee each year. While often mentioned in job contracts and negotiations, comprehending the components of CTC is essential for both employers and employees.

Monetary And Non-Monetary Components

CTC encompasses various elements beyond just the basic salary. It comprises several monetary and non-monetary components, including basic salary, allowances, bonuses, reimbursements, and benefits such as insurance, retirement contributions, stock options, and more. Understanding these components is crucial for employees to gauge the actual value of their compensation package.

For employers, offering an attractive CTC serves as a crucial tool in talent acquisition and retention. A well-structured CTC can distinguish a company from its competitors, attracting top talent and reducing employee turnover. It showcases the holistic value an employee receives beyond the basic pay, emphasising the additional perks and benefits offered.

Basic Salary Serves As The Foundation Of CTC

Basic salary serves as the foundation of CTC, often constituting a significant portion. Allowances, including house rent, travel, medical, or any other special allowances, supplement the basic pay. Companies may also offer performance-based bonuses or incentives, which can significantly enhance an employee’s overall compensation. Non-monetary benefits play an equally pivotal role in CTC. These include contributions towards health insurance, retirement plans like provident fund or pension, stock options, and other perks like wellness programs, flexible work arrangements, or educational reimbursements. While these may not directly contribute to immediate income, they add substantial value to the overall compensation package.Our Approach

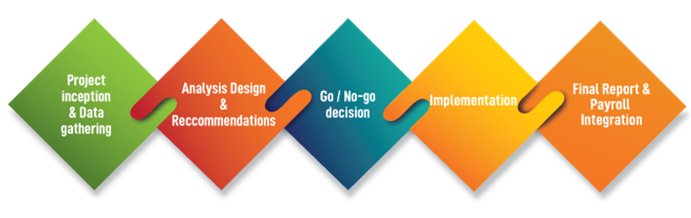

The methodology that we will use during the design and implementation assistance of a uniform CTC package structure for all staff employed by the organisation is based on sequenced phases, as defined below:

Understanding The CTC Breakdown

Understanding the CTC breakdown is crucial for employees while evaluating job offers and negotiating terms. It empowers them to assess the true worth of their compensation beyond the advertised salary figure. For employers, transparently communicating the components of CTC helps in attracting and retaining talent by showcasing the comprehensive value they offer beyond mere salaries. In essence, grasping the nuances of CTC goes beyond understanding salary figures; it involves recognising the comprehensive value a job offers or employment holds. It forms the cornerstone for both employers and employees to make informed decisions, fostering a mutually beneficial relationship that goes beyond monetary compensation.Contact us to assist your organisation [email protected] or call us via +2711 026 3442. Visit our Facebook page. Read more articles here.